does maine tax your retirement

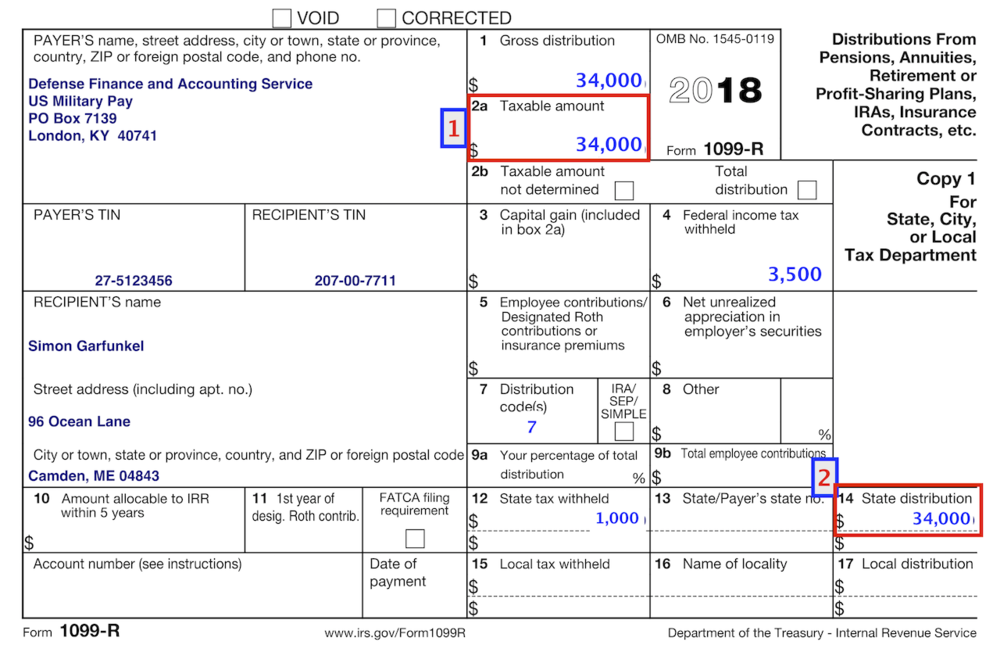

Subtract the amount in Box 14 from. If you file as part of a couple and earn a combined income of between 32000 and 44000 up to 50 percent of your benefits may be subject to taxation.

Maine Relief Checks 2022 Ca H Maine

The income tax rates are graduated with rates ranging from 58.

. Deduct up to 10000 of pension and annuity income. Established a 39 flat income tax rate and eliminated state tax on retirement income in 2022. Also your retirement distributions will be subject to state income tax.

If you make 70000 a year living in the region of Maine USA you will be taxed 12188. The income tax rates are graduated with rates ranging from 58 to 715 for tax. For more information call the Compliance Division of Maine Revenue Services at 207 624-9595 or e-mail compliancetaxmainegov.

Recipients of an employer pension are entitled to choose not to have income tax withheld from their payments or to change their withholding election. Your average tax rate is 1198 and your marginal tax rate is 22. Employer Self Service login.

Permanently exempted groceries from the state sales tax in 2022. See below Pick-up Contributions. Retiree paid Federal taxes on contributions made before January 1 1989.

The state does not tax social security income and it also provides a 10000 deduction for retirement income. Deduct up to 10000 of pension. A manual entry will be made using the Maine State wages found in Box 14 of 1099-R.

In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a. The 10000 must be reduced by all taxable and nontaxable social. State Income Tax Range.

A lack of tax. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. June 6 2019 239 am.

Call us toll free. June 6 2019 239 am. One of the downsides to living in Maine is the fact that the.

While Maine does not tax Social Security income other forms of retirement income are taxed at rates as high as 715. The Pension Income Deduction. Reduced by social security received.

Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states. To All MainePERS Retirees. One of the biggest factors that will determine your tax bill in retirement is where you live and.

Corporate Income Tax 1120ME Employer Withholding Wages pensions Backup 941ME and ME UC-1 Pass-through Entity Withholding 941P-ME and Returns. 3 on up to 20000 of taxable income for married joint filers and up to 10000 for those filing individually 699 on the amount over 1 million for. Individual Income Tax 1040ME Maine generally imposes an income tax on all individuals that have Maine-source income.

On the other hand if you. The Maine Public Employee Retirement System MPERS serves the public with sound retirement services to Maine governments. Also your retirement distributions will be subject to state.

Maine Income Tax Calculator 2021. Does Maine Tax Retirement Pensions. Maine generally imposes an income tax on all individuals that have Maine-source income.

If you believe that your refund may be.

Maine State Tax Guide Kiplinger

Retiring In Maine Vs New Hampshire Which Is Better 2021 Aging Greatly

The Most Tax Friendly States To Retire

Maine Retirement Tax Friendliness Smartasset

Maine Retirement Guide Maine Best Places To Retire Top Retirements

State Income Tax Rates And Brackets 2021 Tax Foundation

11 Pros And Cons Of Retiring In Maine 2020 Aging Greatly

For Some Mainers Retirement Isn T How They Envisioned Newscentermaine Com

States That Won T Tax Your Federal Retirement Income Government Executive

Pension Exemptions Benefit Wealthy Households And Compromise Resources Mecep

Pros And Cons Of Retiring In Maine Cumberland Crossing

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Best Worst States To Retire In 2022 Guide

State Taxation Of Retirement Pension And Social Security Income Wolters Kluwer